Wells Fargo facts for kids

Company logo since 2019

|

|

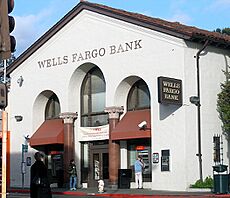

Wells Fargo's office in San Francisco, California

|

|

| Public | |

| Traded as |

|

| ISIN | ISIN: [https://isin.toolforge.org/?language=en&isin=US9497461015 US9497461015] |

| Industry | |

| Predecessors |

|

| Founded | January 24, 1929 in Minneapolis, Minnesota, U.S. (as Northwest Bancorporation) April 1983 (as Norwest Corporation) November 2, 1998 (as Wells Fargo & Company) |

| Founders | (Wells Fargo Bank) |

| Headquarters | Sioux Falls, South Dakota, U.S. (legal); 30 Hudson Yards New York, NY 10001 U.S. (executive) |

|

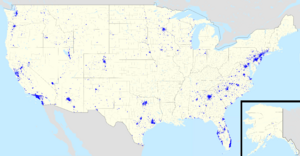

Number of locations

|

|

|

Area served

|

Worldwide |

|

Key people

|

|

| Products |

|

| Revenue | |

|

Operating income

|

|

| Total assets | |

| Total equity | |

|

Number of employees

|

238,698 (2022) |

| Subsidiaries |

|

Wells Fargo & Company is an American multinational financial services company with a significant global presence. The company operates in 35 countries and serves over 70 million customers worldwide. It is a systemically important financial institution according to the Financial Stability Board, and is considered one of the "Big Four Banks" in the United States, alongside JPMorgan Chase, Bank of America, and Citigroup.

The firm's primary subsidiary is Wells Fargo Bank, N.A., a national bank that designates its Sioux Falls, South Dakota, site as its main office (and therefore is treated by most U.S. federal courts as a citizen of South Dakota). It is the fourth-largest bank in the United States by total assets and is also one of the largest as ranked by bank deposits and market capitalization. It has 8,050 branches and 13,000 automated teller machines and 2,000 stand-alone mortgage branches. It is the second-largest retail mortgage originator in the United States, originating one out of every four home loans and services $1.8 trillion in home mortgages, one of the largest servicing portfolios in the US. It is one of the most valuable bank brands. Wells Fargo is ranked 47th on the Fortune 500 list of the largest companies in the U.S.

In addition to banking, the company provides equipment financing via subsidiaries including Wells Fargo Rail and provides investment management and stockbrokerage services. A key part of Wells Fargo's business strategy is cross-selling, the practice of encouraging existing customers to buy additional banking services. This led to the Wells Fargo cross-selling scandal.

Wells Fargo has international offices in London, Dublin, Paris, Dubai, Singapore, Tokyo, Shanghai, Beijing, and Toronto, among others. Back-offices are in India and the Philippines with more than 20,000 staff.

Wells Fargo operates under Charter No. 1, the first national bank charter issued in the United States. This charter was issued to First National Bank of Philadelphia on June 20, 1863, by the Office of the Comptroller of the Currency. Wells Fargo, in its present form, is a result of a merger between the original Wells Fargo & Company and Minneapolis-based Norwest Corporation in 1998. The merged company took the better-known Wells Fargo name and moved to Wells Fargo's hub in San Francisco. At the same time, Norwest's banking subsidiary merged with Wells Fargo's Sioux Falls-based banking subsidiary. Wells Fargo became a coast-to-coast bank with the 2008 acquisition of Charlotte-based Wachovia.

History

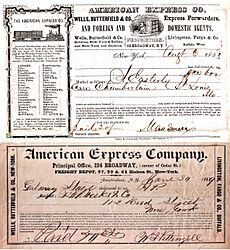

Henry Wells and William G. Fargo, who founded American Express along with John Butterfield, formed Wells Fargo & Company in 1852 to provide "express" and banking services to California, which was growing rapidly due to the California Gold Rush. Its earliest and most significant tasks included transporting gold from the Philadelphia Mint and "express" mail delivery that was faster and less expensive than U.S. Mail. American Express was not interested in serving California.

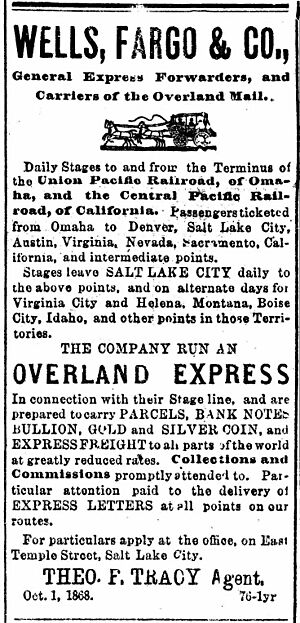

By the end of the California Gold Rush, Wells Fargo was a dominant express and banking organization in the West, making large shipments of gold and delivering mail and supplies. It was also the primary lender of Butterfield Overland Mail Company, which ran a 2,757-mile route through the Southwest to San Francisco and was nicknamed the "Butterfield Line" after the name of the company's president, John Butterfield. In 1860, Congress failed to pass the annual Post Office appropriation bill, leaving the Post Office unable to pay Overland Mail Company. This caused Overland to default on its debts to Wells Fargo, allowing Wells Fargo to take control of the mail route. Wells Fargo then operated the western portion of the Pony Express.

Six years later, the "Grand Consolidation" united Wells Fargo, Holladay, and Overland Mail stage lines under the Wells Fargo name.

In 1872, Lloyd Tevis, a friend of the Central Pacific "Big Four" and holder of rights to operate an express service over the Transcontinental Railroad, became president of the company after acquiring a large stake, a position he held until 1892.

In 1905, Wells Fargo separated its banking and express operations, and Wells Fargo's bank merged with the Nevada National Bank to form the Wells Fargo Nevada National Bank.

During the First World War, the United States government nationalized Wells Fargo's express business into a federal agency known as the US Railway Express Agency (REA). After the war, the REA was privatized and continued service until 1975.

In 1923, Wells Fargo Nevada merged with the Union Trust Company to form the Wells Fargo Bank & Union Trust Company.

In 1954, Wells Fargo & Union Trust shortened its name to Wells Fargo Bank. Four years later, it merged with American Trust Company to form the Wells Fargo Bank American Trust Company. It changed its name back to Wells Fargo Bank in 1962.

In 1968, Wells Fargo was converted to a federal banking charter and became Wells Fargo Bank, N.A. In that same year, Wells Fargo merged with Henry Trione's Sonoma Mortgage in a $10.8 million stock transfer, making Trione the largest shareholder in Wells Fargo until Warren Buffett and Walter Annenberg surpassed him.

One year later, Wells Fargo & Company holding company was formed, with Wells Fargo Bank as its main subsidiary.

In September 1983, a Wells Fargo armored truck depot in West Hartford, Connecticut, was the victim of the White Eagle robbery. The robbery was organized by Los Macheteros (a guerrilla group seeking Puerto Rican independence from the United States) and involved an insider armored truck guard. It was the largest US bank theft to date with $7.1 million stolen.

Throughout the 1980s and '90s, Wells Fargo completed a series of acquisitions. In 1986, it acquired Crocker National Bank from Midland Bank. Then, in 1987 it acquired the personal trust business of Bank of America. In 1988, it acquired Barclays Bank of California from Barclays plc. In 1991, Wells Fargo spent $491 million to acquire 130 branches in California from Great American Bank. In 1996, Wells Fargo acquired First Interstate Bancorp for $11.6 billion. Integration went poorly as many executives left.

Wells Fargo became the first major US financial services firm to offer internet banking, in May 1995.

After its string of acquisitions, in 1998, Wells Fargo Bank was acquired by Norwest Corporation of Minneapolis, with the combined company assuming the Wells Fargo name.

It then began on another set of acquisitions, starting in 2000, when Wells Fargo Bank acquired National Bank of Alaska and First Security Corporation. In late 2001, it acquired H.D. Vest Financial Services for $128 million, but sold it in 2015 for $580 million. In 2007, Wells Fargo acquired Greater Bay Bancorp, which had $7.4 billion in assets, in a $1.5 billion transaction. It also acquired Placer Sierra Bank and CIT Group's construction unit that same year. In 2008, Wells Fargo acquired United Bancorporation of Wyoming and Century Bancshares of Texas.

On October 3, 2008, after Wachovia turned down an inferior offer from Citigroup, Wachovia agreed to be bought by Wells Fargo for about $14.8 billion in stock. The next day, a New York state judge issued a temporary injunction blocking the transaction from going forward while the competing offer from Citigroup was sorted out. Citigroup alleged that it had an exclusivity agreement with Wachovia that barred Wachovia from negotiating with other potential buyers. The injunction was overturned late in the evening on October 5, 2008, by the New York state appeals court. Citigroup and Wells Fargo then entered into negotiations brokered by the FDIC to reach an amicable solution to the impasse. The negotiations failed. Citigroup was unwilling to take on more risk than the $42 billion that would have been the cap under the previous FDIC-backed deal (with the FDIC incurring all losses over $42 billion). Citigroup did not block the merger, but sought damages of $60 billion for breach of an alleged exclusivity agreement with Wachovia.

On October 28, 2008, Wells Fargo received $25 billion of funds via the Emergency Economic Stabilization Act in the form of a preferred stock purchase by the United States Department of the Treasury. As a result of requirements of the government stress tests, the company raised $8.6 billion in capital in May 2009. On December 23, 2009, Wells Fargo redeemed $25 billion of preferred stock issued to the United States Department of the Treasury. As part of the redemption of the preferred stock, Wells Fargo also paid accrued dividends of $131.9 million, bringing the total dividends paid to $1.441 billion since the preferred stock was issued in October 2008.

In April 2009, Wells Fargo acquired North Coast Surety Insurance Services.

In 2010, hedge fund administrator Citco purchased the trust company operation of Wells Fargo in the Cayman Islands.

In 2011, the company hired 25 investment bankers from Citadel LLC.

In April 2012, Wells Fargo acquired Merlin Securities. In December 2012, it was rebranded as Wells Fargo Prime Services. In December of that year, Wells Fargo acquired a 35% stake in The Rock Creek Group LP. The stake was increased to 65% in 2014 but sold back to management in July 2018.

In 2015, Wells Fargo Rail acquired GE Capital Rail Services and merged in with First Union Rail. In late 2015, Wells Fargo acquired three GE units focused on business loans equipment financing.

In March 2017, Wells Fargo announced a plan to offer smartphone-based transactions with mobile wallets including Wells Fargo Wallet, Android Pay and Samsung Pay.

In June 2018, Wells Fargo sold all 52 of its physical bank branch locations in Indiana, Michigan, and Ohio to Flagstar Bank.

In September 2018, Wells Fargo announced it would cut 26,450 jobs by 2020 to reduce costs by $4 billion.

In March 2019, CEO Tim Sloan resigned amidst the Wells Fargo account fraud scandal and former general counsel C. Allen Parker became interim CEO.

In July 2019, Principal Financial Group acquired the company's Institutional Retirement & Trust business.

On September 27, 2019, Charles Scharf was announced as the firm's new CEO.

In 2020, the company sold its student loan portfolio.

In May 2021, the company sold its Canadian Direct Equipment Finance business to Toronto-Dominion Bank.

In 2021, the company sold its asset management division, Wells Fargo Asset Management (WFAM) to private equity firms GTCR and Reverence Capital Partners for $2.1 billion. WFAM had $603 billion in assets under management as of December 31, 2020, of which 33% was invested in money market funds. WFAM was rebranded as Allspring Global Investments.

Environmental record

In 2022, Wells Fargo announced a goal of reducing absolute emissions by companies it lends to in the oil and gas sector by 26% by 2030 from 2019 levels. Some critics say these goals conflict with the bank being the largest lender to fossil fuel companies in the U.S. and one of the largest globally. The company has committed to net zero financed emissions by 2050; however, major environmental groups are skeptical if this goal will be achieved. The company has stated that it will not finance any hydrocarbon exploration projects in the Arctic. The company has also provided financing to renewable energy projects.

Wells Fargo History Museum

The company operates the Wells Fargo History Museum at 420 Montgomery Street, San Francisco. Displays include original stagecoaches, photographs, gold nuggets and mining artifacts, the Pony Express, telegraph equipment, and historic bank artifacts. The museum also has a gift shop. In January 2015, armed robbers in an SUV smashed through the museum's glass doors and stole gold nuggets. The company previously operated other museums but those have since closed.

Charity

On March 2, 2022, Wells Fargo announced $1 million donation to the American Red Cross that will be used for Ukrainian refugees fleeing from the Russian invasion.

In April 2022, The Wells Fargo foundation announced its pledge of $210 million toward racial equity in homeownership. With $60 million of the donation awarded in Wealth Opportunities Restored through Homeownership (WORTH) grants which will run until 2025. Additionally, $150 million will be committed to lower mortgage rates and reducing the refinancing costs to aid minority homeowners.

In April 2023, TD Jakes Group and Wells Fargo have formalized a 10-year partnership to create inclusive communities for people of all income levels. Wells Fargo has committed approximately $1 billion to fund projects that align with the overall strategy. The first of the projects focuses on the development of mixed-income housing and retail facilities outside of Atlanta.

In December 2023, Wells Fargo appointed Darlene Goins as president of the Wells Fargo Foundation and Head of Philanthropy and Community Impact. Previously, she had held leadership roles at FICO, a leading data and analytics company, and at Wells Fargo, she was responsible for helping low-income populations as head of philanthropy for financial health. She also led the Banking Inclusion Initiative, a 10-year commitment to help people access low-cost basic accounts and help those without bank accounts gain easy access to low-cost banking services and financial education.

See also

In Spanish: Wells Fargo para niños

In Spanish: Wells Fargo para niños

- List of Wells Fargo directors

- List of Wells Fargo presidents

- Wells Fargo Arena

- Wells Fargo Center

- Big Four banks